.jpeg)

Flexible Funding and Growth

ICAG is a diversified investment group powered by a team of experienced, proven finance professionals. We were established to create long-term value by providing tailored finance solutions. We stay aligned to the objectives of our client companies and committed to developing growth strategies.

Investments

Capital Markets

Acquisitions

Designed to Drive Growth

.jpeg)

Our mission is to promote alignment with our client companies and generate healthy growth through a mix of financial support and collaborative financial problem solving. Built upon a structure that fosters and enables creative solutions to client needs, ICAG employs a team of innovative individuals who work collaboratively to bring forth forward-thinking data-driven solutions.

We are focused on supporting growth and capturing value through our facility or trenched drawdown funding approach. Our primary product is a PIPE, a private investment in public equity. PIPEs represent a relatively inexpensive and efficient means for a publicly traded company to obtain additional capital funding. The ICAG PIPE also represents surety of funding in a short time frame.

Financing

Loans and Public Subscriptions vs PIPEs

Loans are simple cash transactions to be paid back with interest. They're generally non-dilutive and can provide a business with capital in a fairly straightforward way. They're also accessible and are usually expensive funding options. Many quoted equity companies struggle to secure funding from public subscriptions or rights issues for various reasons including balance sheet constraints and lack of appetite in particular stocks. These can also be expensive funding options.

Private Investments in Public Equities (PIPEs) represent a relatively inexpensive and efficient means for a publicly-traded company to obtain additional capital funding. PIPEs in the form of a ‘convertible’ instrument provide an efficient means for public companies to raise capital usually in amounts of less than $100 million and often we provide our funding through a structured drawdown approach. In lieu of funds advanced to the client company; the lender will receive repayment (by exercising the ‘convertible’) by way of a discount offered on the price of new shares issued to the lender (usually 10 percent of the market price of the shares). This is generally less than the discount to an underwriter (often 20 percent to 30 percent) in a typical follow-on public subscription offering.

Taking on a PIPE is a positive signal to the market because it shows there is confidence and underlying liquidity and volume in a company stock and focused on pursuing growth opportunities. Our structure and efficient process gives us the ability to quickly implement our tailored PIPE solutions, aligned to driving growth in the client company.

PIPEs usually involve the sale of either common shares or convertible securities (which convert into shares of common equity at a fixed rate). Our PIPE issuances typically represent 10 percent to 15 percent of the issuer’s outstanding share capital. These securities are sold at a specified discount to the current market price of the issuer’s listed shares, usually 5 percent to 15 percent. In addition, the investor usually receives warrants to purchase additional shares typically at a discounted price. As part of the arrangement, a company will generally undertake to ensure that the privately-placed securities will become freely tradable within a relatively short time - perhaps ninety days or less after the closing of the transaction.

The factors that determine the speed with which an issuer can complete a PIPE with ICAG are similar in each jurisdiction, namely whether:-

- a client has sufficient authorised but unissued share capital

- the board of directors (or its equivalent) has been granted the authority to issue shares without pre-emptive rights, and

- the PIPE structure is within the authority granted to the board of directors. In general, if each of the above conditions have been met, the parties will be able to structure a transaction that capitalises on two of the main benefits of PIPEs - speed and confidentiality

Whatever the challenge, ICAG is committed to delivering a quick implementation process aligned to growth.

Our Team

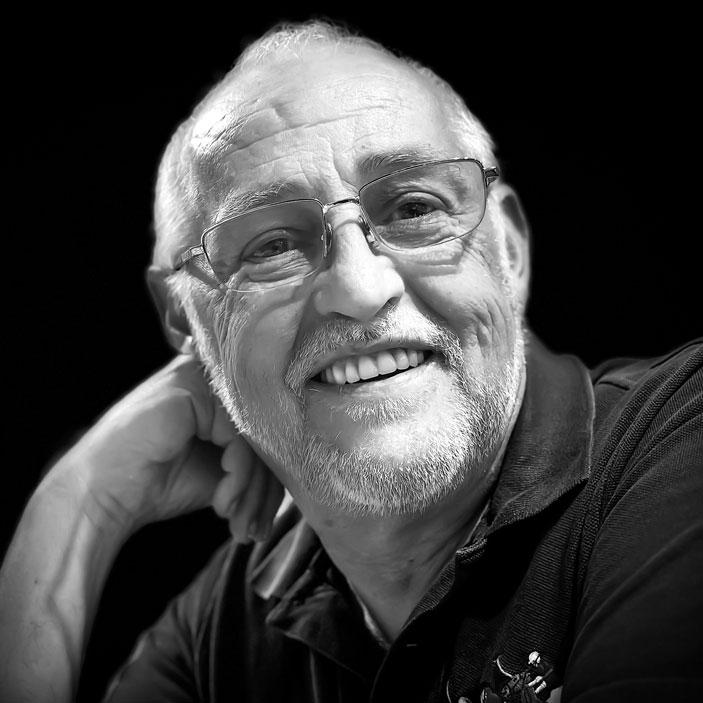

David Scanlan

Principal

Since 1988, David has been developing and successfully implementing strategic plans to advance organizational missions and objectives to promote revenue, profitability, and growth. He also proudly served in the Corps of the Royal Engineers for the British Army.

Andrew McCulley

Managing Director

Andrew McCulley specialises in corporate finance and fund management. He has sector experience in equity loans operating in regulated markets. Across a career spanning more than 20 years, Andrew has been providing regulated personal and corporate financial advice for retail and institutional investors.

Chris Coleman

Head of Trading

Chris was a trader with Scott Goff/Smith New Court, then Panmure Gordon before becoming Head of Sales Trading at Nomura Evolution and Merchant Securities in London. He also has wide ranging experience raising funds for quoted companies.

Jean Paul Rohan

Head of Corporate Affairs

Jean Paul is a digital media specialist and drives direct development opportunities by leveraging the ICAG brand to increase reach to potential target entities. He is harnessing social media and content aggregation promoting the success of target companies.

Colin Conway

Principal

Colin has a diversified background of 15 years in special situations investing, restructurings, specialty finance, and other alternative credit transactions. He is currently the CEO of Oliphant Financial an opportunistic credit investment company.

Contact Us

Our support team is available to answer your questions. Submit the form below and we'll come back to you as quickly as possible.